INTEGRATED TAX ADMINISTRATION SYSTEM

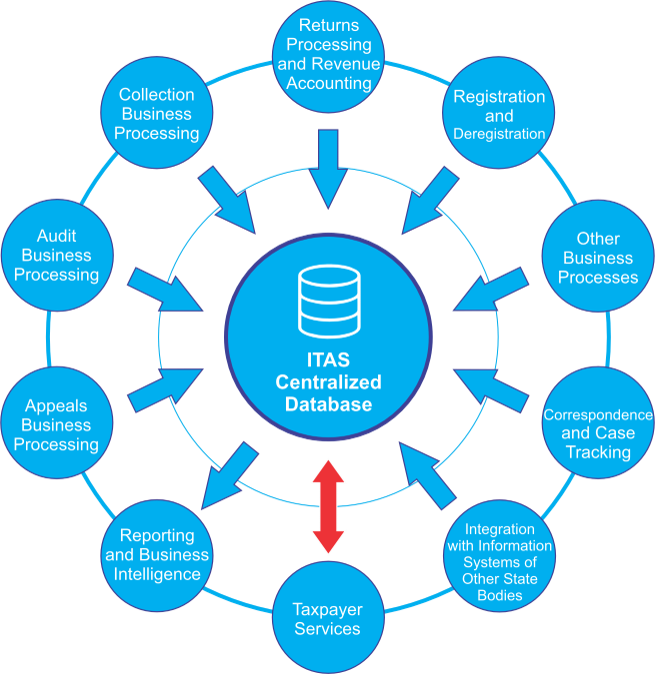

SINAM's INTEGRATED TAX ADMINISTRATION SYSTEM (ITAS) provides a stable platform for mounting reform efforts, improving compliance, and automating organizational processes. For citizens and enterprises, this translates into easier and less expensive means to pay their taxes.

During economic instability, governments strive to improve their tax and revenue collection systems in order to:

Improve income administration;

Institute good governance and transparency;

Better engage the private sector;

Ensure macroeconomic stability.

Reasons to opt for this solution:

Complete and modern features for operations, reporting, and analysis;

Anti-corruption mechanisms through multi-level control over information and processes;

Seamless integration with information systems owned by other regulatory bodies;

First-rate performance in highly sophisticated operational environments;

Case Study: INTEGRATED TAX ADMINISTRATION SYSTEM

Tax Administration Reform and Modernization Project

State Tax Service, Kyrgyz Republic (2010-2013)